Renters Insurance in and around Shoreview

Renters of Shoreview, State Farm can cover you

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Shoreview

- Arden Hills

- Watertown

- New Brighton

- White Bear Lake

- Plymouth

- Minneapolis

- Saint Paul

- Little Canada

- Blaine

- North Oaks

- Mounds View

- Roseville

- Hugo

- Maplewood

- Minnetonka

- Lino Lakes

- Fridley

- Coon Rapids

- Circle Pines

- Falcon Heights

- Dellwood

- Columbia Heights

Home Is Where Your Heart Is

Think about all the stuff you own, from your tablet to furniture to pots and pans to microwave. It adds up! These possessions could need protection too. For renters insurance with State Farm, you've come to the right place.

Renters of Shoreview, State Farm can cover you

Renters insurance can help protect your belongings

Protect Your Home Sweet Rental Home

When renting makes the most sense for you, State Farm can help insure what you do own. State Farm agent Ryan Hangartner can help you create a policy for when the unexpected, like an accident or a water leak, affects your personal belongings.

More renters choose State Farm® for their renters insurance over any other insurer. Shoreview renters, are you ready to discover the benefits of a State Farm renters policy? Contact State Farm Agent Ryan Hangartner today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Ryan at (651) 486-6999 or visit our FAQ page.

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

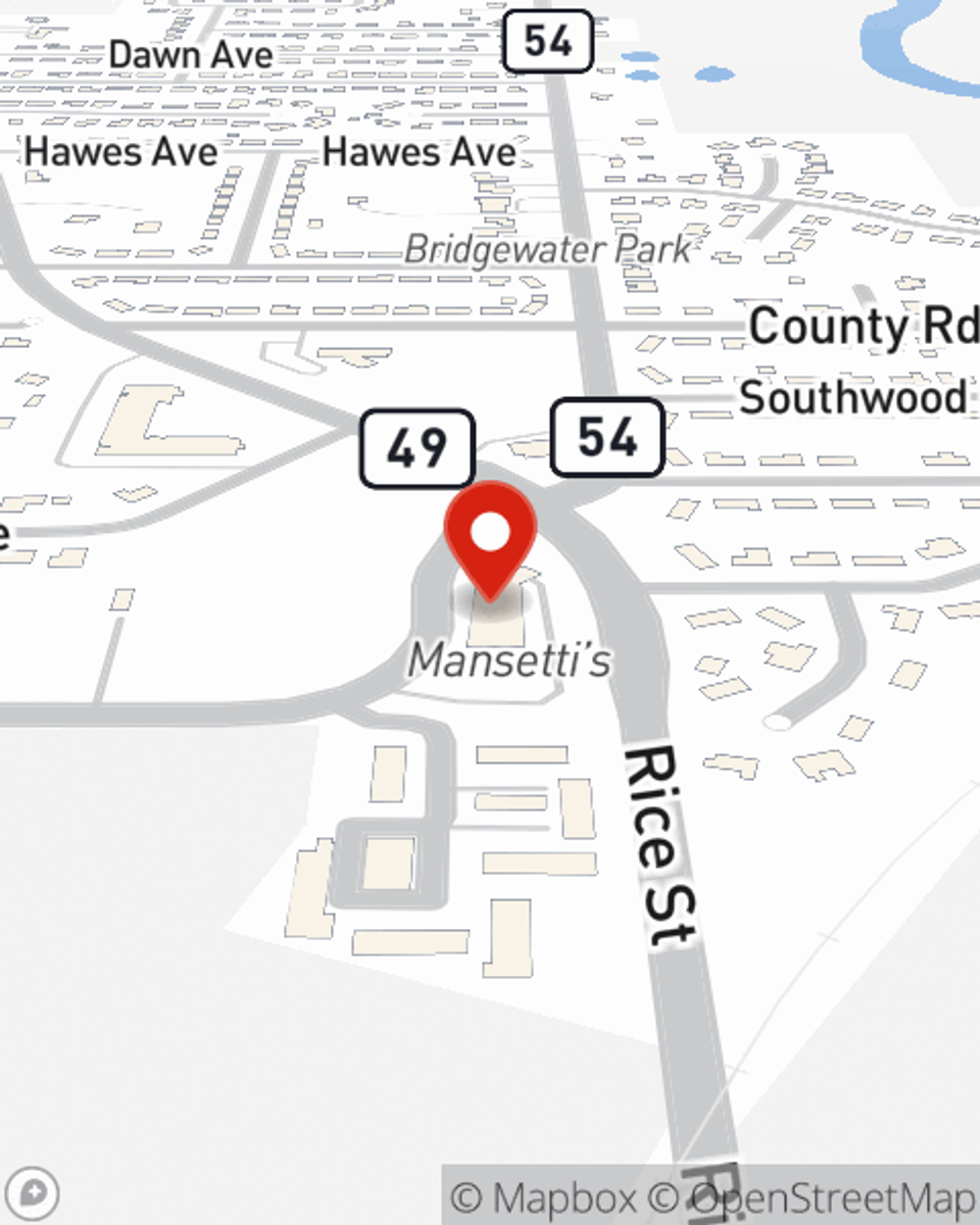

Ryan Hangartner

State Farm® Insurance AgentSimple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.